Cara Buka Deposito Mandiri di Livin' by Mandiri

Deposito Content

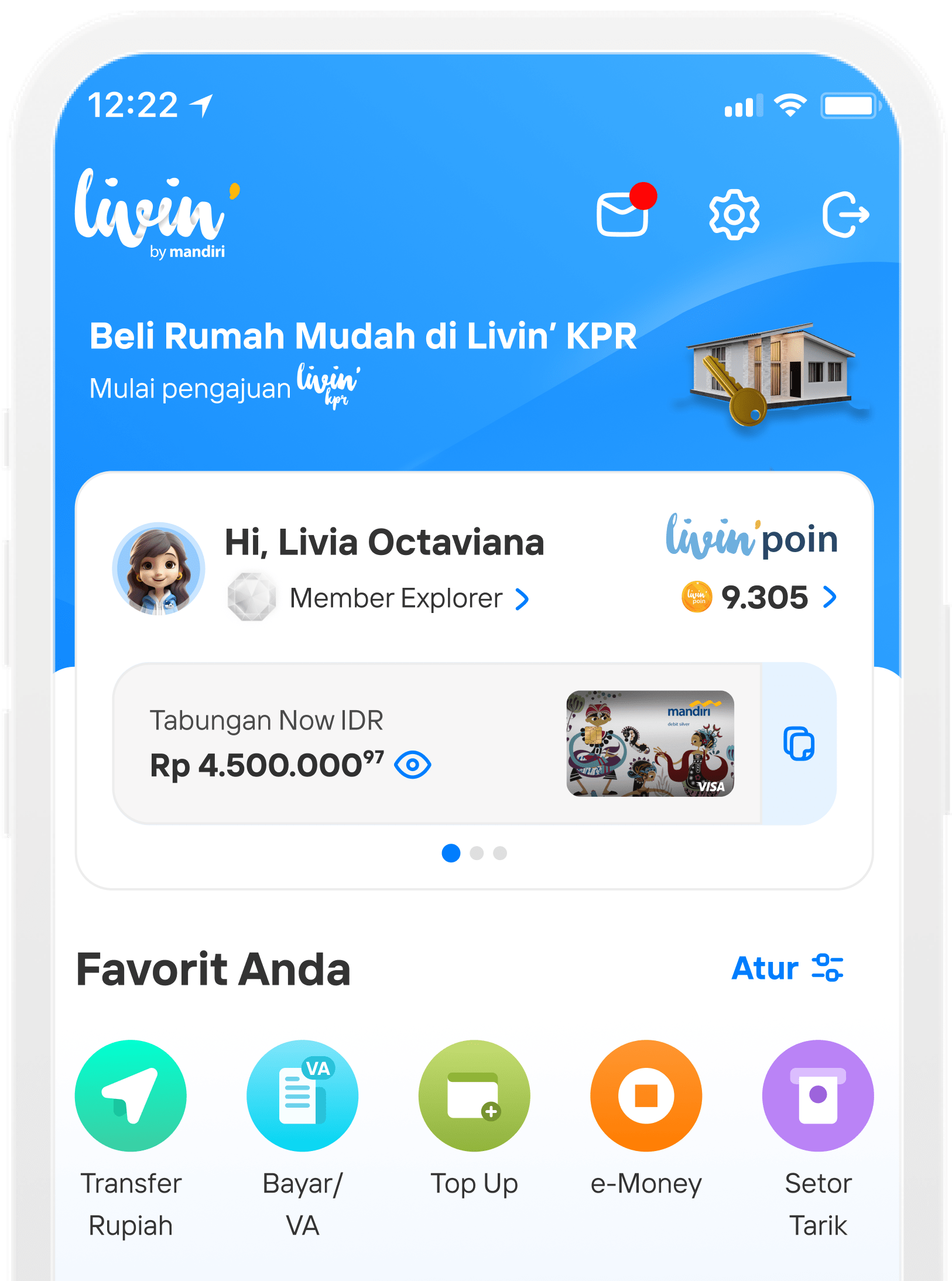

Cara Buka Deposito di Livin' by Mandiri

Temukan segala kemudahan untuk menabung simpanan berjangka dengan bunga menarik dan beragam keuntungan lainnya. Pelajari cara buka Deposito di sini.

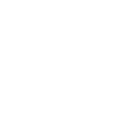

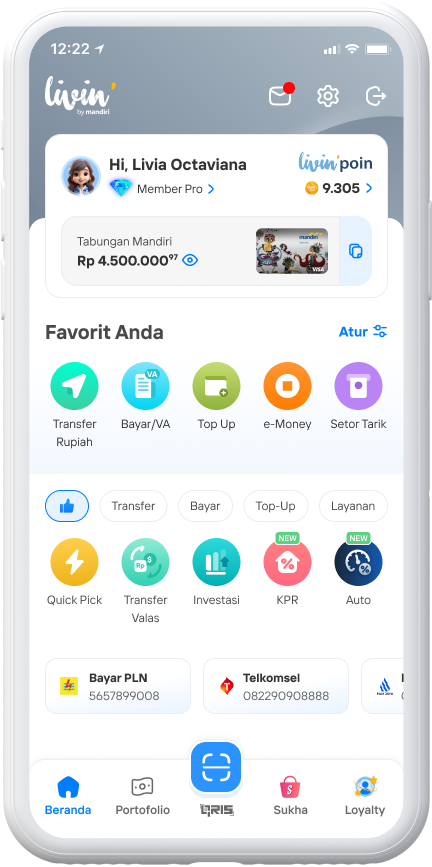

Pilih Portofolio

Pada bagian Deposito kemudian Pilih Banner Buka Deposito

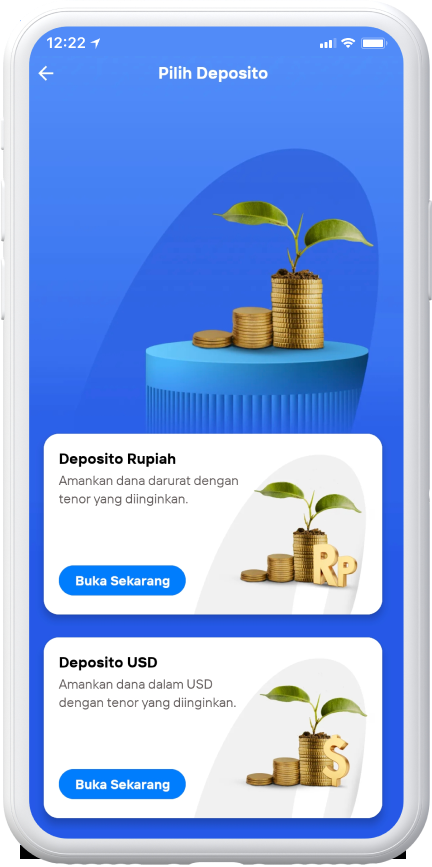

Pilih Deposito Rupiah/USD kemudian klik Buka Sekarang

Setujui syarat & ketentuan

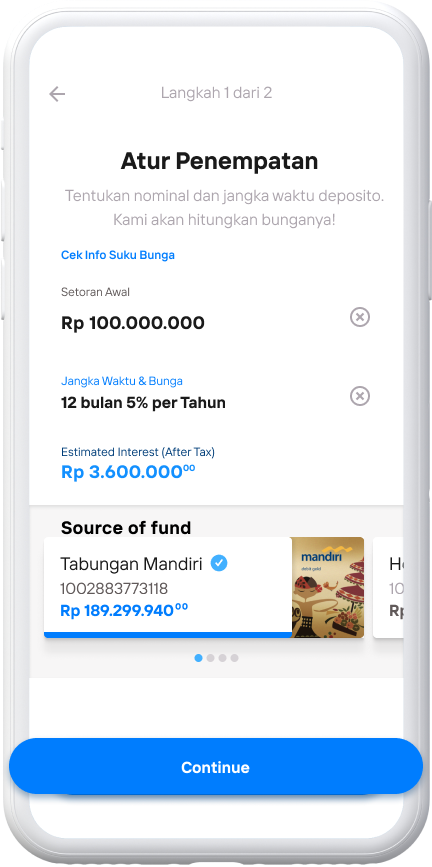

Atur Nominal dan Jangka Waktu deposito sesuai kebutuhan kemudian klik Lanjutkan

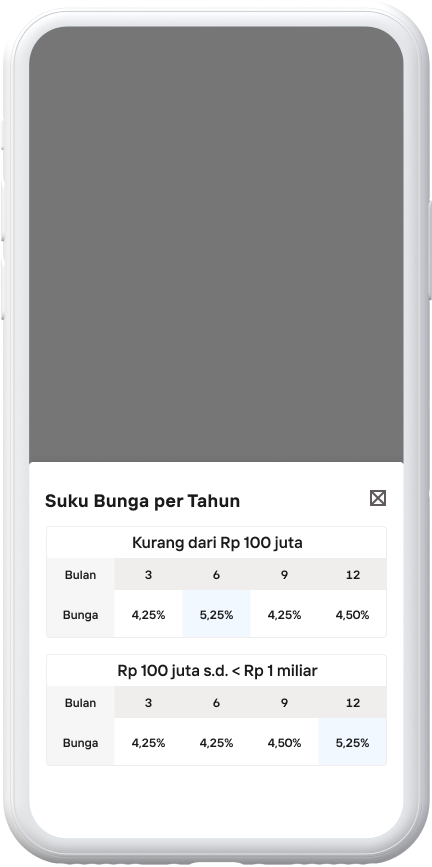

Periksa tingkat suku bunga yang ditawarkan

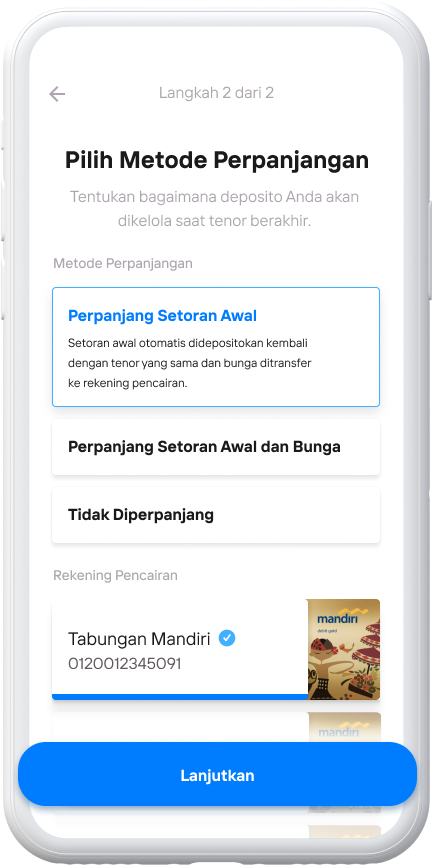

Pilih metode perpanjangan untuk deposito yang Anda inginkan kemudian klik Lanjutkan

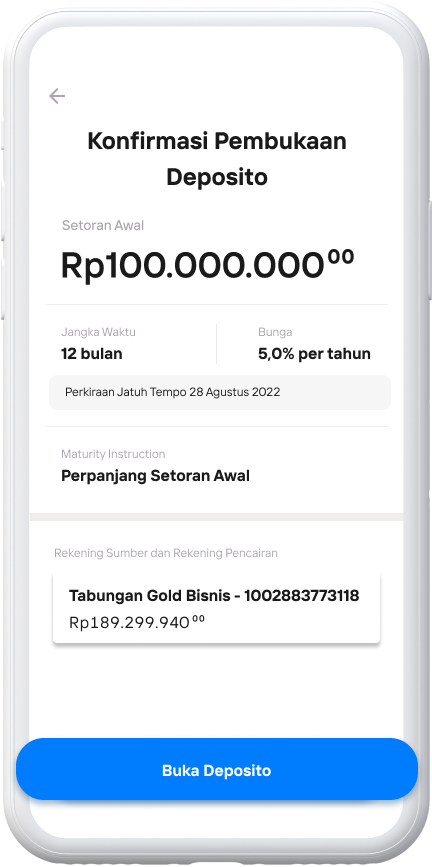

Periksa kembali detail pembukaan deposito kemudian tap Buka Deposito

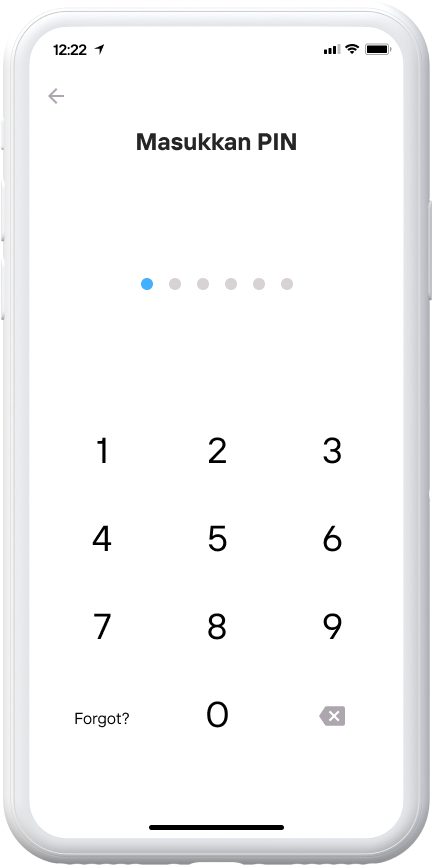

Masukkan Livin' PIN Anda

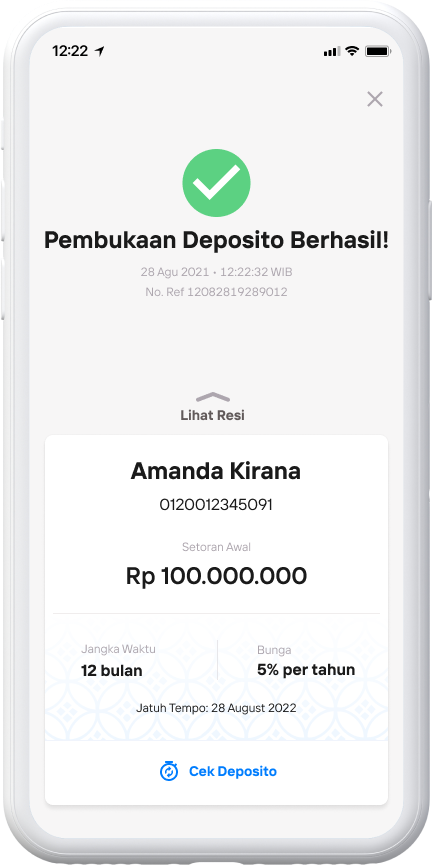

Tunggu ampai muncul notifikasi Pembukaan Deposito Berhasil!

Risiko

-

Deposito Nasabah tidak termasuk dalam program penjaminan Penjaminan Lembaga Penjamin Simpanan (LPS), apabila:

- Nominal seluruh saldo simpanan Nasabah melebihi (equivalen) Rp. 2 (dua) Miliar pada satu bank, baik untuk rekening tunggal maupun rekening gabungan (joint account)

- Suku bunga yang Nasabah dapatkan melebihi tingkat bunga maksimum penjaminan LPS

-

Fluktuasi suku bunga tabungan bisa terjadi mengikuti perkembangan pasar.

-

Nasabah wajib menjaga data rahasia (nomor kartu debit, masa berlaku kartu, CVC/CVV, pin,

username, password, OTP, tanggal lahir, nama ibu kandung), penyalahgunaan data rahasia oleh pihak yang tidak berwenang menjadi tanggung jawab Nasabah sepenuhnya.

-

Nasabah berkewajiban menyediakan informasi dan/atau data sesuai dengan kondisi sesungguhnya dan konsekuensi jika Nasabah tidak menyampaikan informasi dan/atau data yang sebenarnya menjadi tanggung jawab Nasabah sepenuhnya.

Simulasi

|

Nominal |

Tenor |

Suku Bunga per Tahun |

Nominal Suku Bunga Bulanan (sebelum dipotong pajak)* |

Nominal Suku Bunga Bulanan (setelah dipotong pajak)** |

|

Rp10.000.000,- |

1 bulan |

2,25% |

Rp18.493,15 |

Rp14.794,52 |

*) Asumsi jumlah hari adalah 30 hari

**) Besar Pajak Penghasilan (PPh) adalah 20%

Keterangan

-

- Bunga deposito dikreditkan pada saat jatuh tempo

-

- Dalam hal terdapat perubahan suku bunga, maka akan berpengaruh pada nominal bunga yang diterima nasabah

Informasi detail Mandiri Deposito dapat klik di sini

Deposito FAQ

Frequently Asked Questions (FAQs)

Fitur Deposito pada Livin’ by Mandiri dapat digunakan untuk melakukan pembukaan, pemeliharaan, penarikan maupun penutupan.

- Nasabah mengakses fitur sebelum cut off pukul 22.00

- Ada Rekening Tabungan/Giro aktif yang bisa dijadikan Rekening Sumber Dana

- Memiliki Tabungan/Giro dengan mata uang sesuai dengan deposito yang ingin dibuka

Minimum pembukaan Rupiah adalah Rp 1.000.000,- dan USD adalah USD 1.000.

Ya, Rp100.000,- untuk Deposito Rupiah dan USD1 untuk Deposito USD.

Nasabah akan mendapatkan rate Deposito yang sama seperti saat pembukaan sampai dengan jatuh tempo.

Terdapat 3 instruksi jatuh tempo, yaitu :

- Non ARO/Tidak Diperpanjang: Nominal pokok Deposito dan nominal bunga cair ke Rekening Tabungan/Giro Nasabah

- ARO Principal/Perpanjang Pokok Deposito: pokok deposito akan diperpanjang sesuai tenor yang dipilih di awal pembukaan dan nominal bunga dicairkan ke Rekening Tabungan/Giro Nasabah

- ARO Principal & Interest: Nominal bunga deposito ditambahkan ke Nominal Pokok Deposito dan keduanya diperpanjang sesuai tenor yang dipilih di awal pembukaan.

Rekening pencairan merupakan rekening atas nama Nasabah yang akan digunakan sebagai tujuan pencairan saat Deposito jatuh tempo.

Ya, dengan penalti 0,5% dari Nominal Deposito. Bunga terhadap penempatan deposito yang dibatalkan tidak dibayarkan oleh Bank.

Nasabah dapat mengubah nama alias Deposito dengan masuk ke halaman Detail Akun, lalu pilih Edit.

1 dan 3 bulan.

Tidak bisa. Hal ini dikarenakan bilyet fisik yang diterima oleh Nasabah saat pembukaan Deposito di cabang harus diserahkan juga saat pencairan.

Nasabah dapat mengubah instruksi pencairan melalui layar detail akun deposito. Perubahan dapat dilakukan maksimal H-1 pukul 22.00 WIB sebelum tanggal jatuh tempo.

Nasabah dapat mengubah rekening pencairan pada detail akun deposito. New Livin’ by Mandiri akan menampilkan seluruh rekening yang eligible untuk pencairan. Perubahan dapat dilakukan maksimal H-1 pukul 22.00 WIB sebelum tanggal jatuh tempo.

Deposito dengan tipe ARO Principal & Interest tidak cair pada saat jatuh tempo kecuali dengan cara pencairan manual. Rekening Pencairan kembali ditampilkan jika Deposito dicairkan atau diubah ke instruksi pencairan yang lain.

Menu ini diberikan jika pencairan Deposito Tidak Diperpanjang / NON ARO gagal dicairkan otomatis karena Rekening Pencairan bermasalah, misal karena tutup. Nasabah dapat melakukan pencairan manual tanpa dikenakan penalti sepanjang memiliki Rekening Tabungan/Giro yang eligible.

Karena pada bulan Jatuh Tempo, tanggal yang sama dengan tanggal pembukaan Deposito Nasabah tidak ada.

Tidak, Nasabah dapat melakukan pencairan sekalipun hari jatuh tempo ada pada hari libur atau tanggal merah

Di mana pun, kapan pun, apa pun device kamu,

Download Aplikasi Livin’ by Mandiri

Dan dapatkan kemudahan dalam segala urusan finansial sekarang