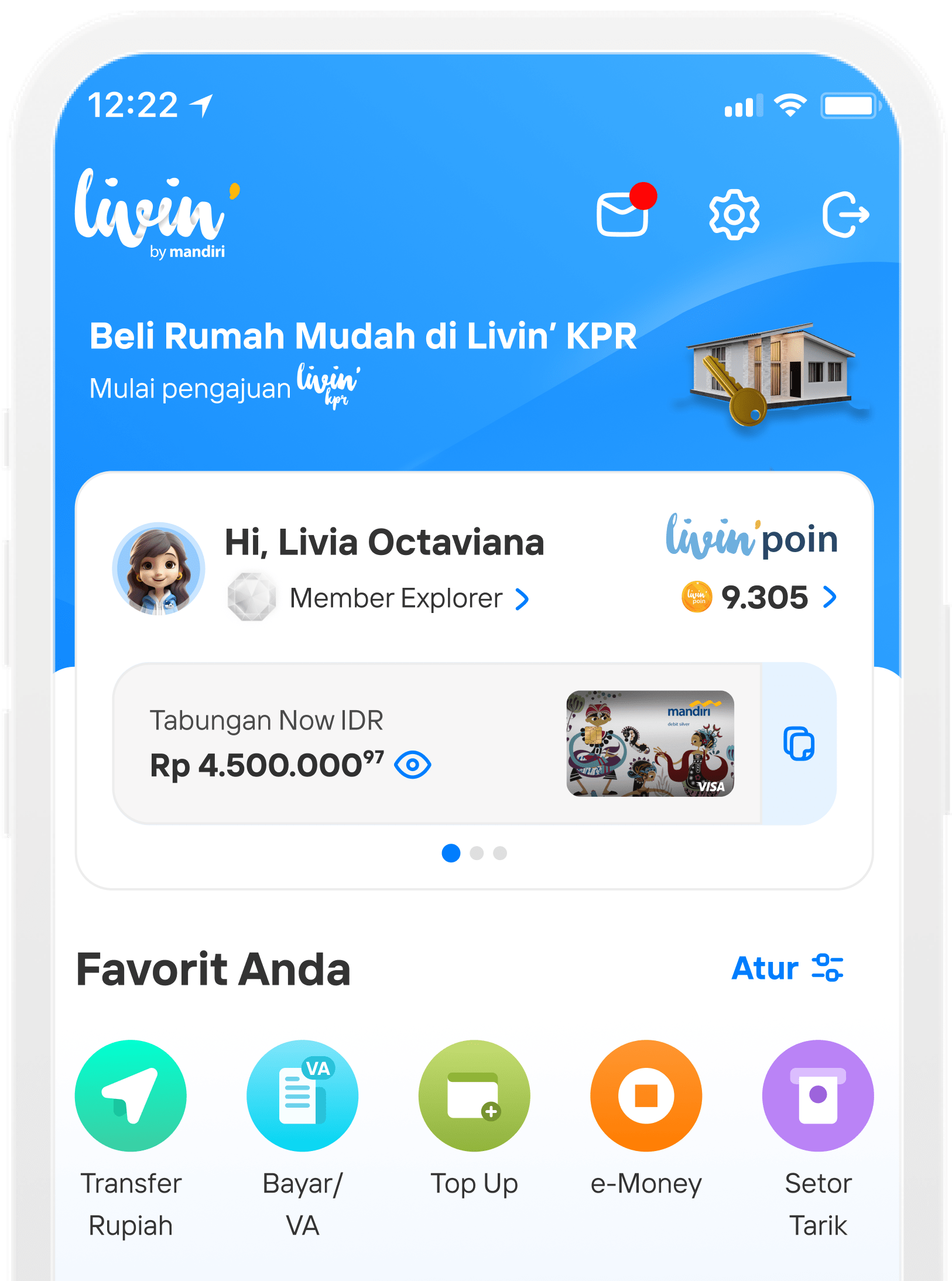

Cara Top Up E-money Mandiri di Livin' by Mandiri

R21 - Instant Top Up e-money (done)

How to Top Up and Set Up Instant e-money

Want to top up your e-money balance through Livin’ by Mandiri? Check out the tutorial here! Even better, you can top up instantly—no login required and no need to enter the amount manually.

Complete product information can be accessed via: https://www.bankmandiri.co.id/e-money

How to top up e-money

Choose e-money from the Livin’ by Mandiri login page.

Tap your e-money card on the phone’s NFC area.

Keep your card in position until it’s successfully read.

Tap the Top Up button.

Select or enter your top-up amount. Check the life protection option if needed, then tap Next.

Make sure the transaction amount is correct, then tap Continue Top-up.

Enter PIN for Livin’.

Tap your card on the NFC area again to update your e-money card balance.

Keep your card in position until the balance is successfully updated.

The e-money balance has been updated and the purchase of the life protection product was successful (if any).

How to set up instant e-money top up

Open Livin’ by Mandiri, then go to e-money menu.

Tap your e-money card. Make sure your phone’s NFC is activated.

Keep your card in position until it’s successfully read.

Tap Instant e-money Settings to top up quickly without entering an amount each time.

Set the top-up amount.

Choose the source of fund, then tap Next.

Input PIN for Livin’.

Done! Instant e-money settings have been saved.

FAQ Top Up E-money R21

Frequently Asked Questions

The e-money feature provides customers with convenient access to manage their electronic money account. Through this menu, users can easily check their current balance, update their balance information, and perform top-up transactions. These features are available both before logging in and after logging in, ensuring seamless and flexible access to your e-money services anytime.

Before updating your e-money balance on Livin’ by Mandiri, please ensure that your smartphone is equipped with NFC (Near Field Communication) functionality.

For customers whose smartphones do not support NFC, e-money top-ups can be made at the nearest branch office, Bank Mandiri ATMs, convenience stores partnered with Bank Mandiri, as well as balance update machines located at several main TransJakarta bus stops and MRT stations.

Livin’ by Mandiri will automatically check if your phone supports NFC. If your phone has NFC but it’s turned off, the app will ask you to turn it on when you open the e-money menu. If your phone doesn’t support NFC, the app will show a message asking you to update your e-money balance at the nearest ATM or partnered convenience store.

Yes, you can. To change the e-money card icon, tap on the e-money menu and open the list of saved cards. Then, select "Personalize", choose the e-money card you want to update, and pick the icon or display style you prefer.

You can change the name (alias) of your e-money card—up to 12 characters. You can also customize the card’s look by choosing a design template or setting your own color, icon, and pattern.

-

Log in to Livin’ by Mandiri.

-

Tap the e-money icon.

-

If your phone has NFC, tap the card to continue. If not, you can enter the card number manually or select it from your saved cards.

-

Tap the “Personalize” button or the edit icon to start personalizing your e-money card.

The transaction history displays Top-up and Payment activities, including the payment location. Please note that location details are available starting from one day after the payment (H+1).

The availability of the transaction history preview depends on the card version. If the preview does not appear, please try tapping your card again—Android users should tap once more, while iOS users should tap the card again as well.

Although the transaction history may not display, the e-money card can still be topped up and used for payments via Livin’ or other available channels. We recommend periodically tapping the card through Livin’ to check if the transaction history becomes accessible.

Please follow the instructions provided in the application and tap your card on your device up to three times. If the application indicates no pending balance and your card balance has not increased, kindly wait for one day (H+1) for the refund to be processed back to your account. Should the refund not appear after this period, please contact Bank Mandiri’s customer service at Mandiri Call 14000 for further assistance.

Top Up e-money with AXA Mandiri Financial Services (AMFS) insurance offers

Livin's customers who top up their e-money balance after login into the app, can see the offering Life Protection Insurance Product from AMFS

Customers can check AMFS Insurance Certificate and Policy sent by AMFS via email registered in Livin'

- Customers can check AXA insurance policy via inbox at Livin by Mandiri

- Customers can check AXA's insurance policy via email

The customer will receive the Insurance Certificate via email sent by AMFS if the transaction is successful. Customer can also see the proof of transaction via receipt in Livin' inbox

Insurance beneficiary need to prepare:

-

Death Claim Form that has been filled out correctly and completely (original);

-

Copy of valid Identity Card (KTP)/Passport and/or Temporary Residence Permit Card (KITAS) (for foreign nationals) from the Insured;

-

Copy of Family Card;

-

Statement of Heirs (Original) if required;

-

Chronology of death in the event that the Insured dies not in the Hospital;

-

A statement form from a valid and authorized Doctor about the causes of death in the event that the Insured dies at the Hospital that has been signed

by the Doctor and stamped from the Hospital concerned (original); -

Death certificate/death certificate from the authorized agency. If the insured dies due to an accident outside the territory of the Republic of Indonesia,

the death certificate must be legalized by the local (original) Indonesian Embassy (Embassy of the Republic of Indonesia); -

A certificate of visum et repertum or an original autopsy certificate from the Doctor or Hospital examining the Insured's body in the event that the

Insured dies due to an accident or dies unnaturally (original or legalized photocopy); -

Certificate from the Police in the event that the Insured dies due to an Accident or unnatural death (original or legalized photocopy); and

-

Certificates or other documents deemed necessary by the Insurer related to the submission of claims.

Beneficiaries can submit a claim application to AMFS by:

-

contact AMFS Customer Care Centre at the number: 1500803

-

Send email to customer@axa-mandiri.co.id or

-

send documents to: PT AXA Mandiri Financial Services. AXA Tower, 8th floor. Kuningan City.

-

Documents are delivered directly to: Customer Care Centre. PT AXA Mandiri Financial Services. AXA Tower, ground floor.

-

The Beneficiary submits a max. 90 Calendar Days since the accident occurred

-

AMFS will inform the results of the claim process for max. 14 Business Days or 60 Business Days if further investigation is needed.

-

AMFS makes payment of Insurance Benefits to Beneficiaries max. 5 Business Days

Di mana pun, kapan pun, apa pun device kamu,

Download Aplikasi Livin’ by Mandiri

Dan dapatkan kemudahan dalam segala urusan finansial sekarang