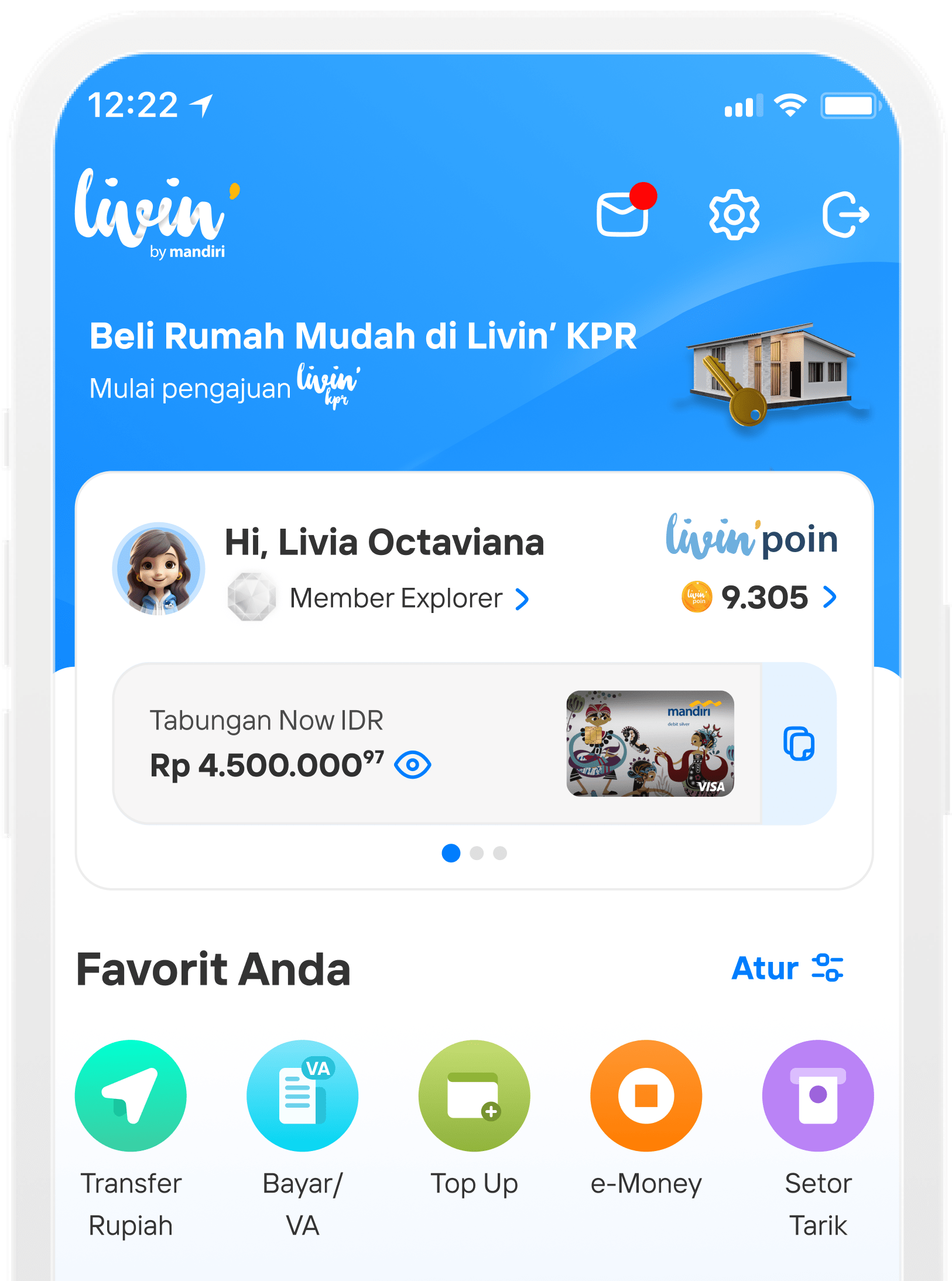

Cara Buka Rekening Mandiri di Livin' by Mandiri

NTB - OTP

How to Register and Open an Account Livin' by Mandiri

Opening a deposit account is now possible for Indonesian citizens abroad. Download Now! Discover all the convenience of financial transactions in Livin' and learn how to use it here.

Select Open My First Account

Select Open Account

Select Debit Card then select Continue .

Read the Terms and Conditions and select I Agree.

Prepare your e-KTP for the account opening process then select Next

Press the camera icon & make sure all information on the e-KTP can be read clearly then select Continue.

Make sure your NIK and Custodial Mother's Name are correct, then select Continue.

Your e-KTP is verified then select Continue

Select the country code number you are using

Select Country Code

Enter Mobile Number and tap Continue.

Read the warning pop up and select Send SMS.

Check OTP SMS from Bank Mandiri

Enter the OTP code obtained from the SMS.

Verification Successful

Enter Email

Then select Verify

Enter the verification code you got from the email

Verification Successful

Create Password

Ensure that the password meets the specified criteria

Confirm the password and select Continue.

Create PIN

Confirm PIN

Password and PIN are successfully saved then select Continue.

Choose according to your purpose

For example, choose To save

Complete the following data according to your current place of residence then Continue

Enter your employment data and upload your NPWP by tapping the column or Upload Later by tapping the check box.

NPWP Verification Successful

Enter where you work

Confirm account ownership, then select I Agree.

Choose according to your obligations

Data entry complete

Select Start Verification for Face verification

Make sure you are in a bright place with your face clearly visible.

follow the guidelines shown on the screen Please blink

Verification successful

Setting up your account

Opening Mandiri Tabungan Now Successfully

Risks and Fee

- Before opening an account through Livin' by Mandiri, make sure:

-

You do not have a product with Bank Mandiri before

-

The data inputted is in accordance with the data source

-

Photos of documents are appropriate (not blurry / not cut / not damaged)

-

Face photo matches the one on your ID card

-

Stable internet connection

-

Email and cellphone number have not been registered with Bank Mandiri

-

-

You must use a mobile phone number other than an Indonesian mobile phone number to be considered a customer domiciled abroad.

-

When opening an account through Livin' by Mandiri, you may be charged the following fees:

-

Initial deposit and physical debit card creation fee of IDR100,000.00

-

Settlement fee of IDR25,000.00

-

Savings admin fee of IDR5,000.00 per month

-

Card admin fee varies depending on the debit card you choose, starting from IDR1,000.00 - IDR8,500.00

-

For details of your Tabungan Now savings account, click here.

-

FAQ - NTB

Frequently Asked Questions

You can open a bank account online through Livin’ by Mandiri anytime, anywhere, 24 hours a day, 7 days a week. However, if additional verification via video call with a Bank Mandiri staff member is required, it can only be done daily from 08:00 AM to 09:00 PM (WIB - Western Indonesia Time).

An Indonesian citizen (WNI) residing in Indonesia who:

-

Has an e-KTP registered with Dukcapil (Indonesian Civil Registry).

-

Has never been a Bank Mandiri customer, or has closed all previous accounts.

An Foreign Nationals (WNA) residing in Indonesia who hold a passport and either ITAS/ITAP (Temporary/Permanent Stay Permit) or a Golden Visa issued by the Ministry of Law and Human Rights, Directorate General of Immigration.

It can be done in countries listed in the Supported Countries List provided by Bank Mandiri.

-

An active phone number to receive OTP (One-Time Password) for verification

-

A valid email address to receive OTP (One-Time Password) for verification

Make sure the data entered in the app matches your physical document (e-KTP or passport) exactly.

Make sure the SMS sender is ‘BANKMANDIRI’ and the email is from noreply.livin@bankmandiri.co.id, not from any other phone numbers or emails, including those claiming to be from Bank Mandiri. Also, ensure the country code prefix matches the country code you have selected. Do not share your OTP with anyone, including those who claim to be from Bank Mandiri.

Make sure to use an active mobile phone number from a foreign provider to receive the SMS OTP for registration verification.

Use the ‘Resend OTP’ option to get a new 6-digit code and enter it correctly in the verification field.

You will get three attempts to complete the face recognition. If it still fails and you're prompted to visit a branch, the process cannot continue online and must be done at a Bank Mandiri branch.

You can use either SIM 1 or SIM 2, as long as the selected number is from a foreign provider and is active.

When registering on Livin’ by Mandiri, customers will automatically be issued:

-

Tabungan NOW in Indonesian Rupiah is automatically created when registering for Livin’ by Mandiri

-

Multicurrency Individual Savings can be added after the NOW Savings product is created

-

Investment

-

Credit Card

-

Paylater

Yes. The account will be automatically activated once the customer successfully passes the verification process, and completes the initial deposit.

After successfully opening an account via Livin’ by Mandiri, the account number will be displayed on the Home screen of the app. It will also be sent to your verified email address.

No, customers will not receive a passbook for accounts opened online. Transaction history and balance information can be viewed through the Livin’ by Mandiri app.

Those who successfully open an online account through Livin’ by Mandiri can make the initial deposit via transfer (from a Bank Mandiri account or other banks) or through e-Wallets that have partnered with Livin’ by Mandiri.

Yes, you can perform transactions using the Livin’ by Mandiri app once the initial deposit is received, even before the debit card arrives.

The minimum deposit is the equivalent of IDR 100,000.

Di mana pun, kapan pun, apa pun device kamu,

Download Aplikasi Livin’ by Mandiri

Dan dapatkan kemudahan dalam segala urusan finansial sekarang