Livin' by Mandiri - #BeyondSuperAPP

LIVIN - SECTION 1 R19

Simply Beyond

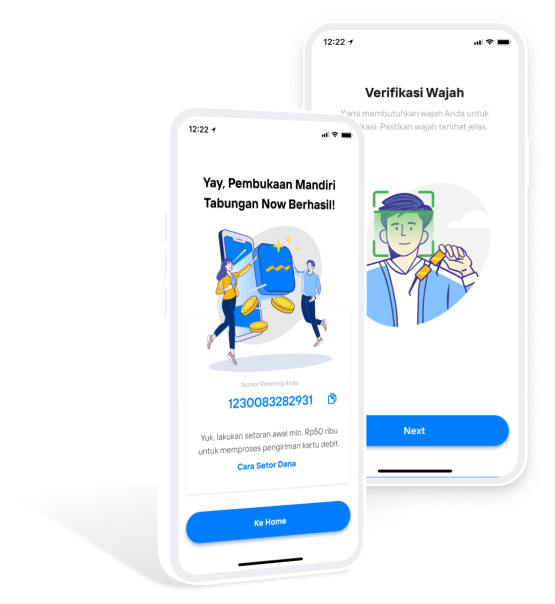

Livin' #BeyondSuperAPP, Innovation doesn't stop here and will continue to provide a new experience of future banking even further.

LIVIN - SECTION 2 R19

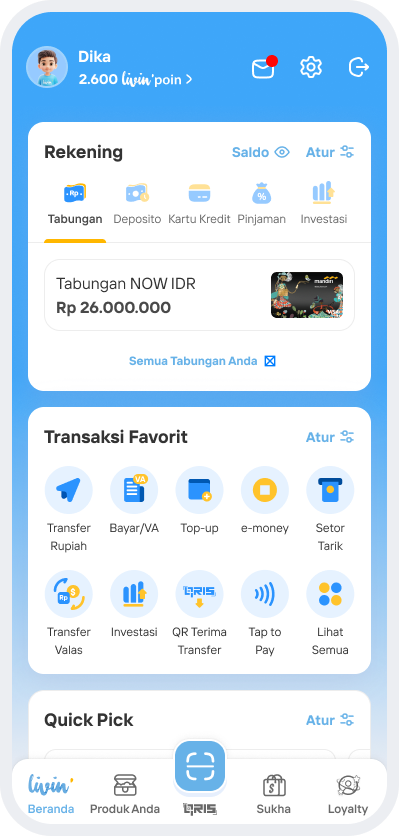

Everyday Banking and More!

The leading financial Super APP, which moves quickly to prioritize your needs. From daily transactions to housing, both domestic and international, along with hundreds of other innovative features.

Beyond Banking

Our beyond banking innovations go beyond daily transactions, even fulfilling lifestyle and entertainment needs.

The Next Level of Banking Experience

Integrated loyalty program with leading partners, customers can collect, monitor, and redeem Livin' Points in real-time.

LIVIN - SECTION 3 R17

Home Livin - SECTION 4 R19

#BeyondSuperAPP

Cara Mudah Daftar Livin' Merchant

Tambah Produk

Cara menerima pesanan via Kasir

Mulai Belanja Online

Pengaturan Akun

Menerima Pesanan Online

FAQ LIVIN

Frequently Asked Questions (FAQ)

The risks of digital transactions can be minimized by:

- Use a supported device for a smoother transaction experience.

- Perform transactions with a stable internet connection.

- Always update the Livin’ app to get the latest features and security.

- Keep your personal information confidential and do not share OTP codes, passwords, PINs, or other credentials with anyone.

When using Livin' by Mandiri, you may be charged for the following:

- Account-related fees, such as account opening fees, admin fees, and minimum balance fees

- Card-related fees, such as physical debit card issuance fees and card administration fees

- Feature usage fees, such as transaction fees

For detailed information on savings accounts, you can see the following link.

Information on fees related to feature usage can be found on the Bank Mandiri website for the respective feature and/or in your Livin' app.