Surat Berharga Negara Sekunder

SBN Sekunder

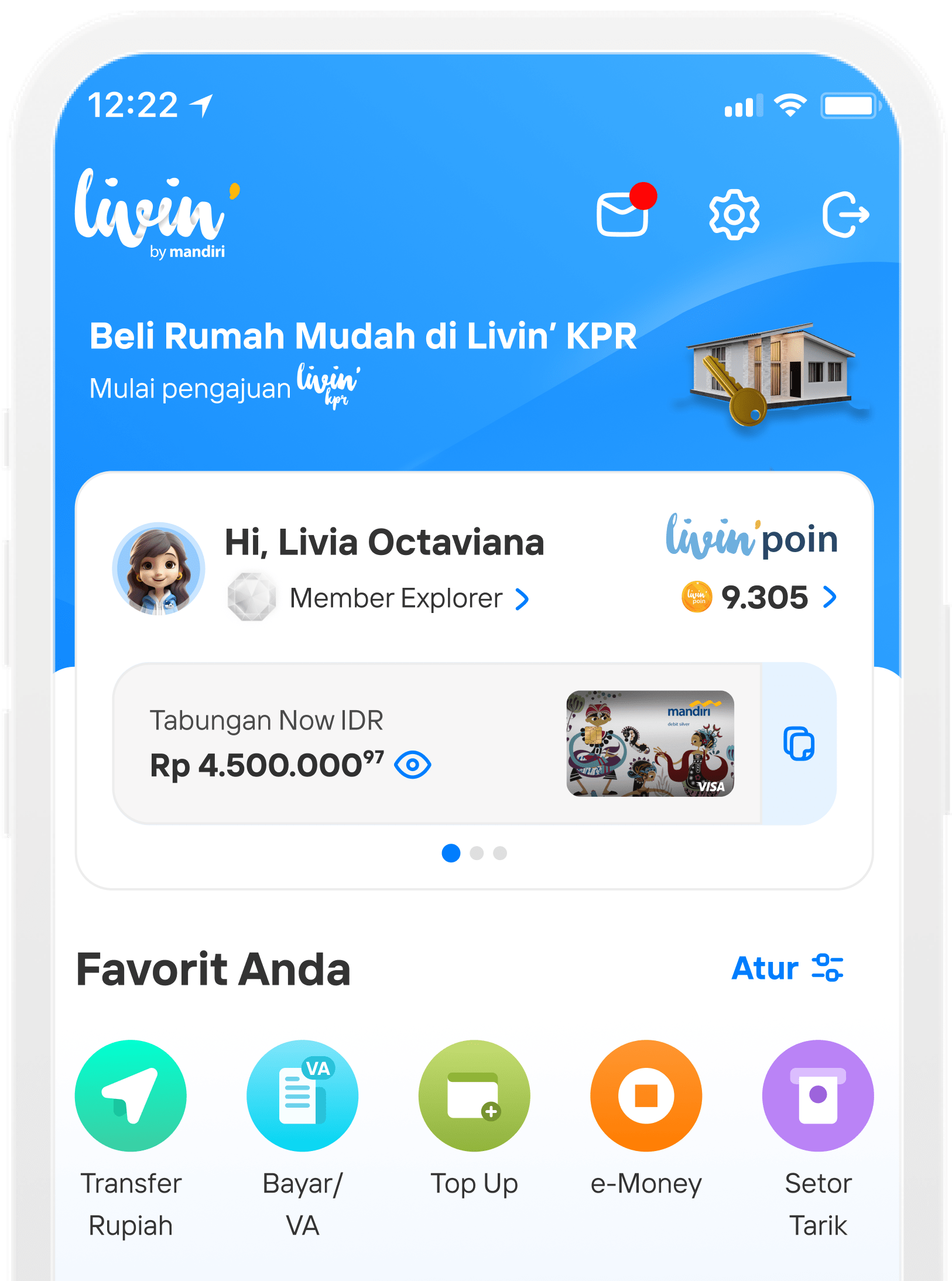

Secondary Government Securities at Livin' by Mandiri

Secondary SBN Registration

Select the Investment menu

Select SBN secondary market banner

Click Register Now on the registration page

Agree to the terms and conditions, then select I Agree.

Complete your personal details, then select Continue.

Complete your current task, then select Continue.

Enter your investment objective, then select Continue.

Select how long you will invest for, then select Continue.

Select your investment knowledge and experience, then select Continue.

Select what percentage of your assets to allocate to investments, then select Continue.

Select the percentage of investment decline tolerance, then select Continue.

Select whether you depend on the investment results, then select Continue.

Select the account to be used for investment transactions on Livin'.

Confirm your registration details and then select Submit Registration Details.

Enter your PIN

Your registration is being processed within a maximum of one working day.

SBN registration successful

Purchase of Secondary Government Securities

Go to Investment menu

Tap See All on the Government Bonds section

Go to Secondary Bond page

Tap Buy button

Read the terms and conditions, then tap I Agree

Enter the transaction amount, then tap Continue

On the confirmation page, check your bond details then tap Pay Now

Enter Livin’ PIN

Then, your SBN purchase will be submitted

Secondary Government Securities Sales

Select Investment menu

Go to Portfolio page

Select the bond that you wish to sell

Tap Sell button

Read Terms and Conditions thoroughly then tap I Agree

Enter the transaction amount, then select Continue

On the confirmation page, check your bond details then tap Sell Now

Enter Livin’ PIN

Then, your bond sale request will be processed

FAQ Sekunder

Frequently Asked Questions (FAQs)

A. Secondary Market Government Securities (SBN)

- The Secondary Market is a market where investors can buy and sell SBNs after these financial instruments have been listed on the exchange or issued on the primary market.

- Secondary SBNs are SBNs that are traded on the Secondary Market.

The products offered by Livin' by Mandiri are:

- ORI

- SR

- FR

- INDON

- INDOIS

- ROI

The series of these products follows the availability of goods in the market.

The products offered by Livin' by Mandiri are:

- There is a fixed periodic income in the form of coupons received per coupon payment period.

- There is a potential profit (capital gain) from the market price.

- Government Securities products are guaranteed by the Government based on the Law.

- Ease of making transactions and monitoring portfolios.

Secondary bond risks for customers include:

- Market risk, which is the risk of a decline in the value of the product, include the resale price, which is affected by the prevailing interest rate or general market conditions.

- Callable risk, i.e. the bond issuer redeems (pays off) the bond earlier than maturity.

- Customers are required to have a Single Investor Identification (SID), Bank Indonesia - Account Identifier (BI AID), and Security Account (SCA) registered with Bank Mandiri.

- The customer has a Taxpayer Identification Number (NPWP) registered with the Director General of Taxes.

- Customers are required to have an active account with IDR currency for IDR bond purchase and sale transactions and an active account with foreign currency (USD) for foreign exchange bond purchase and sale transactions (USD). The active account will be used as a source of purchase funds as well as the purpose of disbursing coupons and principal at maturity, and sales proceeds.

YTM atau Yield to Maturity adalah tingkat pengembalian total yang akan diperoleh Nasabah (investor) jika membeli obligasi pada harga pasar saat ini dan menahannya hingga jatuh tempo.

B. Registration of Bond in the Secondary Market

Some of the requirements that are required and must be completed before registering for secondary bond at Livin' by Mandiri:

- Indonesian citizens as evidenced by a valid ID card and registered with the Dukcapil.

- Have an active account that is used as a source of purchase funds and disbursement purposes (coupons, principal at maturity, or sales proceeds).

- Have an NPWP registered with the Director General of Taxes.

The registration process for secondary bond at Livin' by Mandiri takes a maximum of 2 working days.

Yes. Customers will receive notifications, including in the form of push notifications and information through the inbox on Livin' by Mandiri related to information on the registration process to become a secondary market investor. If the registration process is successful, the Customer will be informed of the Single Investor Identification (SID) number.

If the Customer does not have an active SID and BI AID recorded in the Bank Mandiri system, the Customer needs to register again as an investor first.

If the Customer does not have an active SID and BI AID recorded in the Bank Mandiri system, the Customer needs to register again as an investor first.

Customers who have registered for SBN Secondary Market, have made transactions, have SID and Custodial Accounts, as well as AID with active status recorded in Bank Mandiri's system, no longer need to register as investors.

C. Purchase of Government Securities (SBN) in the Secondary Market

Customers must meet the requirements below to purchase Secondary bond at Livin' by Mandiri:

- Have an active SID and AID recorded in the Bank Mandiri system and registered with Bank Indonesia services.

- Not in a blocked status (a status that does not allow the Customer to transact investments) on the Bank Mandiri system.

- Have an active account for sources of funds and disbursements (coupons and principal at maturity).

- The currency of the Secondary SBN purchased must be the same as the currency of the source account of the purchase funds.

Nasabah harus memenuhi persyaratan di bawah ini agar dapat melakukan pembelian SBN Pasar Sekunder di Livin’ by Mandiri:

Custodian Fees:

- The Custodian fee consists of IDR 25,000 settlement instruction fee to the Central Registry system (BI-SSSS) and 11% tax of IDR 2,750 for the purchase of IDR-denominated bonds.

- The Custodian fee consists of USD 3.15 settlement instruction fee to the Central Registry system (Euroclear) and an 11% tax of USD 0.35 for the purchase of USD-denominated bonds.

These fees are subject to change at any time in accordance with the provisions of Bank Mandiri.

For information, in the event that there is a current coupon due to the settlement of the purchase transaction occurring between the coupon payment dates, the customer will be charged an additional fee for the current coupon with a nominal amount following Bank Mandiri's calculation.

The minimum transaction fee for secondary market SBN is IDR 1,000,000.

Secondary Market SBN purchase transactions can be made during exchange hours (09.45 - 15.30 WIB) and are only valid on exchange days.

Product information documents are documents that contain information related to the features of SBN Secondary Market products in accordance with the series offered through Livin' by Mandiri.

Each savings account can have a maximum of 1 (one) Virtual Debit Card and 1 (one) physical Debit Card.

Product information documents can be accessed on the product details page available at Livin' by Mandiri.

The Customer will receive a Trade Confirmation and Transaction Advice in the Customer's email as proof of purchase of Secondary Market SBN products.

The customer cannot cancel the purchase that has already been made.

Yes. The Secondary Market SBN purchase portfolio made by the Customer can be viewed through Livin' by Mandiri. The Customer's portfolio will be entered on the day of settlement.

D. Secondary Market Government Securities (SBN) Sales

Customers must meet the requirements below in order to be able to sell Secondary Market Government Securities (SBN) at Livin' by Mandiri:

- Have an active SID, Custodial Account, and AID registered in the Bank Mandiri system and registered with Bank Indonesia services.

- Not in a blocked status (a status that does not allow the Customer to transact investments) on the Bank Mandiri system.

- Have an active account as a disbursement account for the proceeds and current coupons obtained for sales made.

There are fees that will be charged to investor customers for sales transactions, including:

- Custodian Fees:

- The Custodian fee consists of Rp25,000 settlement instruction fee to the Central Registry system (BI-SSSS) and an 11% tax of Rp2,750 for the sale of IDR-denominated bonds.

- The Custodian fee consists of USD 3.15 settlement instruction fee to the Central Registry system (Euroclear) and an 11% tax of USD 0.35 for the sale of USD-denominated bonds. - The stamp duty fee is IDR 10,000 for the sale of IDR bonds or equivalent to IDR 10,000 in accordance with the exchange rate applicable at the time of the transaction for the sale of USD-denominated bonds.

- Taxes (if any) on bond sales transactions in accordance with applicable regulations.

These fees are subject to change at any time in accordance with the provisions of Bank Mandiri.

Secondary Market SBN sales transactions can be carried out during exchange hours (10.00 - 15.30 WIB) and are only valid on exchange days. For products that were previously purchased in the primary market, product sales can be made after the holding period ends.

Product information documents are documents that contain information related to Secondary Market SBN products in accordance with the series offered through Livin' by Mandiri.

Product information documents can be accessed on the product details page available at Livin' by Mandiri.

The Customer will obtain a Trade Confirmation and Transaction Advice in the Customer's email as proof of sale of Secondary Market SBN products.

The customer cannot cancel the sale that has already been made.

Yes. The Secondary Market Government Securities (SBN) sales portfolio carried out by the Customer can be viewed through Livin' by Mandiri. The Customer's portfolio will be entered on the day of settlement.

E. Obstacles and errors in Government Securities (SBN) transactions in the Secondary Market

Customer funds will be credited back to the purchase account on the same day.

Customers can see the sales status in the transaction history, there are 3 sales statuses: sales waiting verification, waiting for fund placement and successful SBN sales. If the SBN sales status is successful, the funds will be credited to the disbursement account. If the funds have not been credited, please contact the nearest branch or Mandiri Call 14000, for further checking.

Customers can contact Mandiri Call 14000, for further checking.

Di mana pun, kapan pun, apa pun device kamu,

Download Aplikasi Livin’ by Mandiri

Dan dapatkan kemudahan dalam segala urusan finansial sekarang