Kredit Agunan Deposito

R21 KAD Content

Kredit Agunan Deposito di Livin' by Mandiri

Credit Application

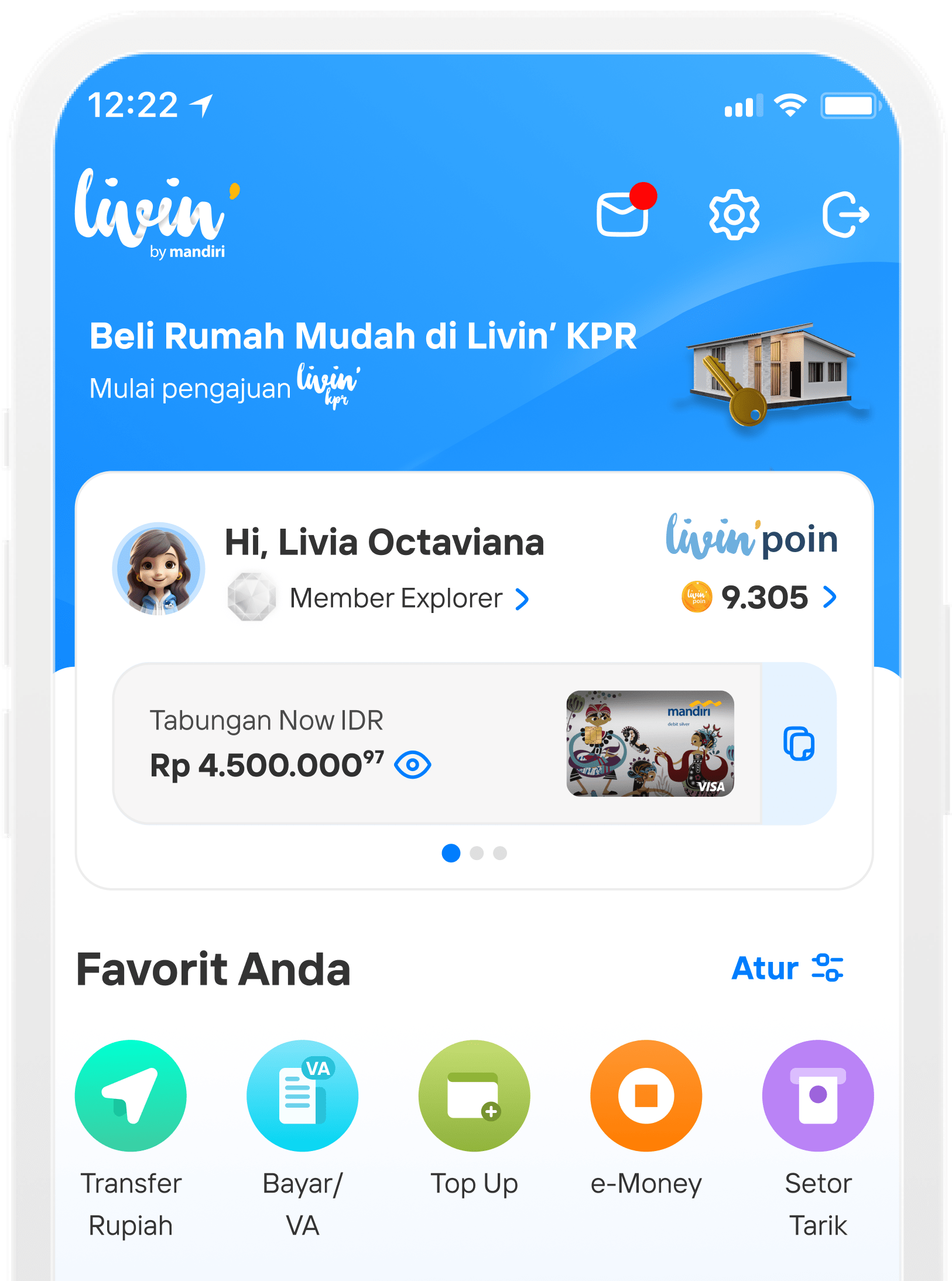

Go to Your Product on Livin’ by Mandiri’s home page.

To apply, select Kredit Agunan Deposito menu on the Loan section.

You can also apply through the Deposito page.

Read the Kredit Agunan Deposito product information carefully, then tap the Apply Now button.

Married customers must apply with their spouse, as spousal consent and face verification are required.

Read the Terms and Conditions, then tap the

I Agree button.

Enter the loan amount as needed, then tap Next.

Select the deposit to be used as collateral. Ensure its value is sufficient and meets your loan requirements.

Choose the Repayment Method according to your needs.

Choose a suitable Tenor. Your deposit will be hold until the loan is fully repaid.

Choose a suitable Tenor. Your deposit will be hold until the loan is fully repaid.

Please select your current Marital Status. If you are married, you will proceed to the spouse’s consent and face verification step.

Please select your current Marital Status. If you are married, you will proceed to the spouse’s consent and face verification step.

Make sure all the application details are correct, then tap Lanjutkan.

Read and agree to the Credit Applicant Statement, then Continue to Face Verification.

Have yourself in front of your camera, then tap Start Selfie.

Make sure your face is ready in front to do face verification.

Keep your face steady until verification succeeds.

Face verification successful! Continue to the next step.

Enter information about your spouse. Make sure the data you provide is accurate.

Enter information about your spouse. Make sure the data you provide is accurate.

Please have your spouse read and understand the content and details of the agreement before approving.

Make sure your spouse is ready in front of the camera to do the face verification.

Keep the face steady until verification succeeds.

Keep the face steady until verification succeeds.

Once verification is completed, the credit applicant will proceed to the next stage.

Select the account that will receive the loan disbursement and payments.

Select the account that will receive the loan disbursement and payments.

Review this details before proceeding. Make sure everything is correct and meets your needs.

Enter your Livin’ PIN.

Your loan application is being processed. Please check the status regularly.

Check the Inbox menu to see the latest status of your loan application progress.

Here you can check the progress and latest loan application status as well as the details.

Signing of the Credit Agreement

When your loan application is approved, Bank Mandiri will send you a notification to your Inbox.

When your loan application is approved, you have to agree and sign the Loan Agreement Document to proceed the loan disbursement.

Read thoroughly to fully understand the Loan Agreement Document before agreeing.

Enter your Livin’ PIN.

After approving the Loan Agreement Document, it will be processed. Please check the status regularly.

After the document is approved, your loan will be disbursed to the account you selected.

The funds will be disbursed. If you're using a deposit with certificate as collateral, please submit the physical certificate to a branch within 3 business days.

You can view account details on the Loan page under Your Products menu.

Congratulations on reaching your dreams with Kredit Agunan Deposito Mandiri!

R21 KAD FAQ

Frequently Asked Questions (FAQs)

A Deposit Collateral Loan is a loan where you use your fixed deposit as a guarantee. Your deposit still earns interest, and at the same time, you can borrow money based on the amount of your deposit.

To apply, you must:

-

Be an Indonesian citizen (individual)

-

Have no non-performing loan (NPL) history in the last 12 months (based on SLIK checks)

-

Not be listed on the Debtor Blacklist (DHN) in the last 12 months

-

Have no legal problems or not be involved in any legal issues

-

Make the deposit through the Livin’ app

-

You can apply anytime and anywhere using the Livin’ app

-

You get a loan without having to withdraw your deposit — your deposit still earns interest

-

You can borrow up to IDR 10 billion

-

The process is fast and easy

Yes, it is possible. If the deposit is issued in the form of a deposit certificate, you can submit the physical deposit certificate to the branch within three (3) working days after the application has been approved.

You may submit the physical deposit certificate at any of the Bank Mandiri branches listed at the following link click here

No, you can submit the physical deposit certificate only at branches that are included in list

You can collateral physical certificate deposits and Livin' deposits in one loan

application for Kredit Agunan Deposito, but you still must submit their physical

certificate to the branch. Upon submission of physical certificate at the branches, you

will receive a copy of the handover minutes (BAST) as proof of the submission of

physical bills at the branch.

NON ARO physical certificate deposits can be used as collateral for Kredit Agunan Deposito with the following conditions:

-

If the tenor of the physical certificate deposit is shorter or equal to the tenor of the application submitted:

(i)NON ARO physical certificate deposits will be converted to ARO deposits by system

(ii)You must fill in the General Application Form stating NON ARO physical certificate deposits are converted into ARO deposits at the branch. -

If the tenor of the physical certificate deposit is longer than the tenor of the application submitted: NON ARO physical certificate deposits will remain NON ARO deposits

No, you must submit a physical certificate that is in accordance with the credit application.

Yes, you must submit a physical certificate that is in accordance with the credit application no more than 3 days. If it is not submitted within the specified time limit, Bank has the right to disburse the deposit in the event of default on its Kredit Agunan Deposito.

-

The loan interest rate is 0.5% on the top of the deposit interest rate

-

Late payment fines start at 2% on the top of the current interest rate, based on the overdue amount

-

An administration fee of IDR 250,000 per loan application

-

A provision fee of 0.1% per year based on the loan amount

-

Interest rates and fees can change based on bank policies

You can borrow min. IDR 1 million and max. IDR 10 billion.

There are three stages in the application process, as follows:

-

Application is being checked

This is the initial verification stage of your loan application, which generally takes approximately 15 minutes. -

Application approved

At this stage, the loan application has been approved by the Bank, and you may proceed with the online signing of the Loan Agreement through the Livin’ by Mandiri application. After the Loan Agreement has been signed, the loan will be further processed by the Bank. -

Funds Disbursed

At this stage, the Bank processes the disbursement of the loan to the your savings account. The disbursement may be completed within approximately 30 (thirty) minutes after the approval and signing processes are completed, subject to data completeness, system availability, and applicable terms and conditions. In certain circumstances, the disbursement process may require a longer processing time.

You can monitor the status of your application through the Inbox in the Livin’ by Mandiri application or via periodic email notifications.

There are 2 ways to pay:

-

Monthly payments: Pay your principal and interest every month on the 15th. The loan can last up to 36 months.

-

Pay principal at the end: Pay interest every month on the 15th, and pay the full principal and remaining interest when the loan ends. This option lasts up to 12 months

-

If you don’t pay, your loan will be considered overdue.

-

If you don’t pay the penalty within 1 day, your deposit will be automatically used to pay off the loan.

-

Your deposit will be used to pay the loan.

-

You will be charged a daily penalty for late payments.

-

Your credit record will show that you missed payments, which is recorded in the Financial Information Service System (SLIK).

If you believe you did not make the transaction, you can report it by calling Mandiri Call at 14000.

You can report the issue by calling Mandiri Call at 14000 or by visiting the nearest Mandiri branch.

Currently, early repayment of a kredit agunan deposito is not allowed before the loan maturity date.

Once submitted, a kredit agunan deposito application cannot be cancelled.

-

You cannot apply for a top-up on an existing kredit agunan deposito that has already been processed and disbursed to your account.

-

If you need additional funds, you may apply for a new kredit agunan deposito after the previous loan has been successfully disbursed.

If your application status remains unchanged for more than 3 days, please contact Mandiri Call at 14000.

You can visit the same branch when you submit the physical certificate.

You can bring the handover minutes (BAST document) and show a notification at Livin by Mandiri that your loan has been paid off.

Di mana pun, kapan pun, apa pun device kamu,

Download Aplikasi Livin’ by Mandiri

Dan dapatkan kemudahan dalam segala urusan finansial sekarang