Cara Buka Tabungan Rencana Mandiri di Livin' by Mandiri

R21 - Buka Mandiri Tabungan Rencana

How to Open a Tabungan Rencana on Livin' by Mandiri

Discover the convenience of saving regularly with Mandiri Tabungan Rencana. Learn how to open Tabungan Rencana here.

How to open a Mandiri Saving Plan

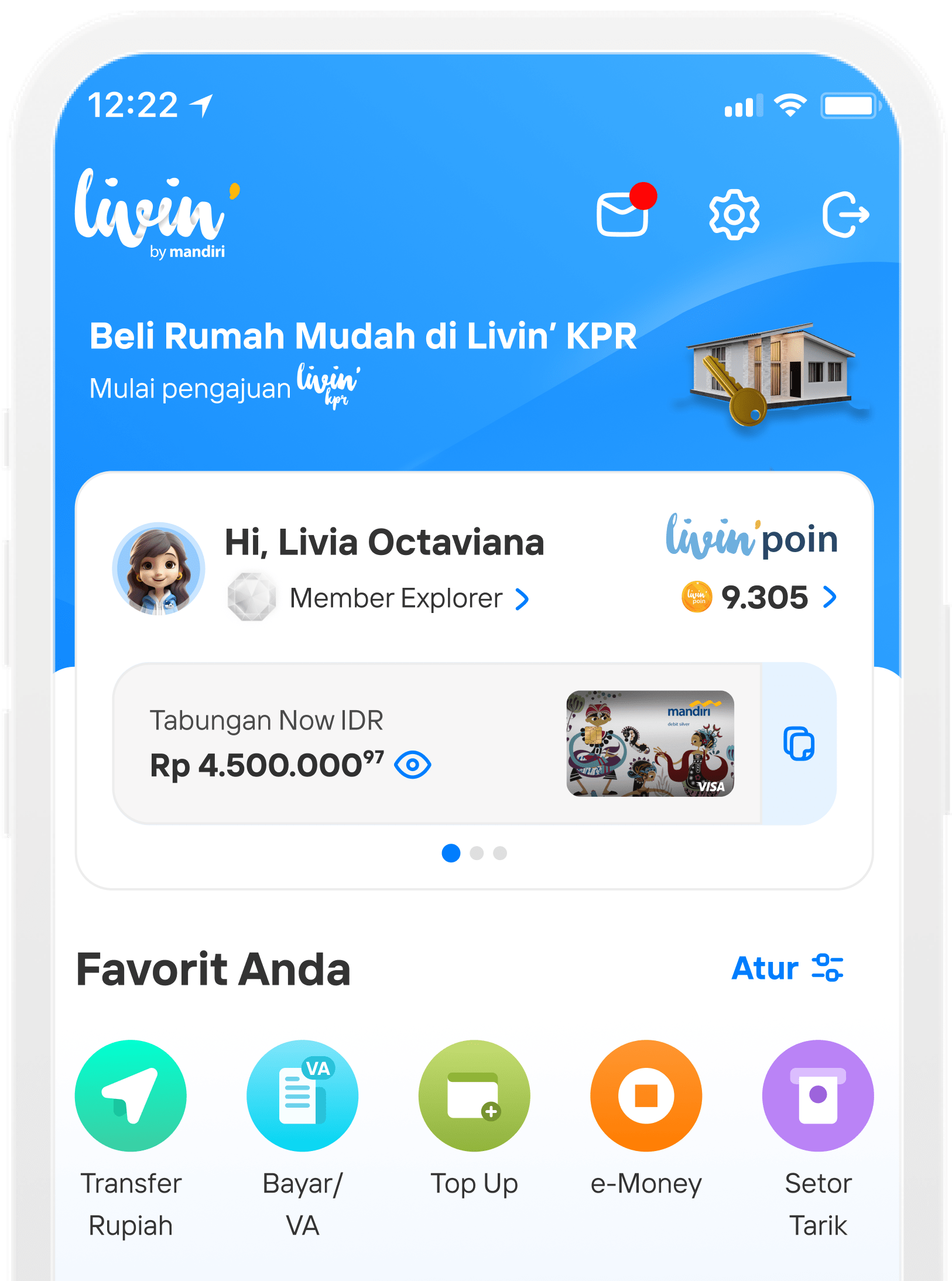

On the Home page Select the Your Product menu

Select Rupiah/USD Savings Plan and then select Open Now

Read Terms & Conditions and click Agree to continue the process

Select Purpose of Savings

Choose your preferred method to reach your goal

Create Savings Name. You can also input referral and branch code (if any)

Detemine the target amount you want to achieve

Decide on the length or period of savings

Set the autodebit date every month

Determine the Insurance Beneficiary

Recheck the saving details and click “Confirm” if all the details are correct.

Enter Your PIN

You have successfully opened Mandiri Tabungan Rencana

Risk

-

The customer's savings are not covered by Lembaga Penjamin Simpanan (LPS) if:

-The total balance of the customer’s savings exceeds (equivalent to) IDR 2 (two) billion in one bank, either in a single account or a joint account.

-The interest rate the customer receives exceeds the maximum interest rate covered by the LPS.

-

Fluctuations in savings interest rates may occur in accordance with market developments.

-

The customer is required to keep their confidential data (debit card number, card expiration date, CVC/CVV, PIN, username, password, OTP, date of birth, mother’s maiden name) secure. Any misuse of confidential data by unauthorized parties is the full responsibility of the customer.

-

The customer is obligated to provide information and/or data that reflects the actual conditions. The consequences of failing to provide accurate information and/or data will be the full responsibility of the customer.

Fee

Detailes information for Mandiri Tabungan Rencana fees, click this link.

Simulation

| Mandiri Tabungan Rencana Method | Nominal | Time Period | Interest Rate | Auto-debit amount per month | Estimated Final Balance |

|---|---|---|---|---|---|

| Target based | IDR 100.000.000,- | 5 years | 1.35% | IDR 1.666.667,- | IDR 103.257.751,35 |

| Budget based | IDR 200.000,- | 2 years | 1.10% | IDR 200.000,- | IDR 4.851.615,38 |

Details information for Mandiri Tabungan Rencana click this link

DOWNLOAD FOOTER

Di mana pun, kapan pun, apa pun device kamu,

Download Aplikasi Livin’ by Mandiri

Dan dapatkan kemudahan dalam segala urusan finansial sekarang