Pemberitahuan Nasabah Fitur Access Fee

FAQ Pemberitahuan Nasabah Fitur Access Fee

FAQ Access fee for foreign card at ATM

An Access Fee is a service charge applied when using a foreign-issued card (non-Indonesian bank debit/credit cardholders when making transactions at Bank Mandiri ATMs.

All foreign cardholders (Visa and Mastercard) who make transactions at Bank Mandiri ATMs in Indonesia.

Bank customers holding JCB and CUP network foreign cards are not charged to this fee.

The Access Fee is 50,000 IDR for each transaction, in addition to any fees that may be set by the issuing bank of each foreign card issuer.

This fee applies to cash withdrawal transactions using foreign cards at Bank Mandiri ATMs.

The access fee will be automatically deducted from your foreign card origin account along with the amount of transactions made at the ATM.

Yes, information about the Access Fee will be displayed on the ATM screen before the transaction is confirmed. Customer can choose to continue or cancel the transaction.

Customers will also get the information on the receipt when the transaction has been completed.

Yes. The application of access fees follows common international banking practices and is in accordance with the requirements of regulators and international networks (Visa, Mastercard, etc.).

No. Access fee only applies to foreign cardholders who transaction at Bank Mandiri ATMs

You can contact Bank Mandiri Call Center 14000 or via email Mandiricare@bankmandiri.co.id for further information.

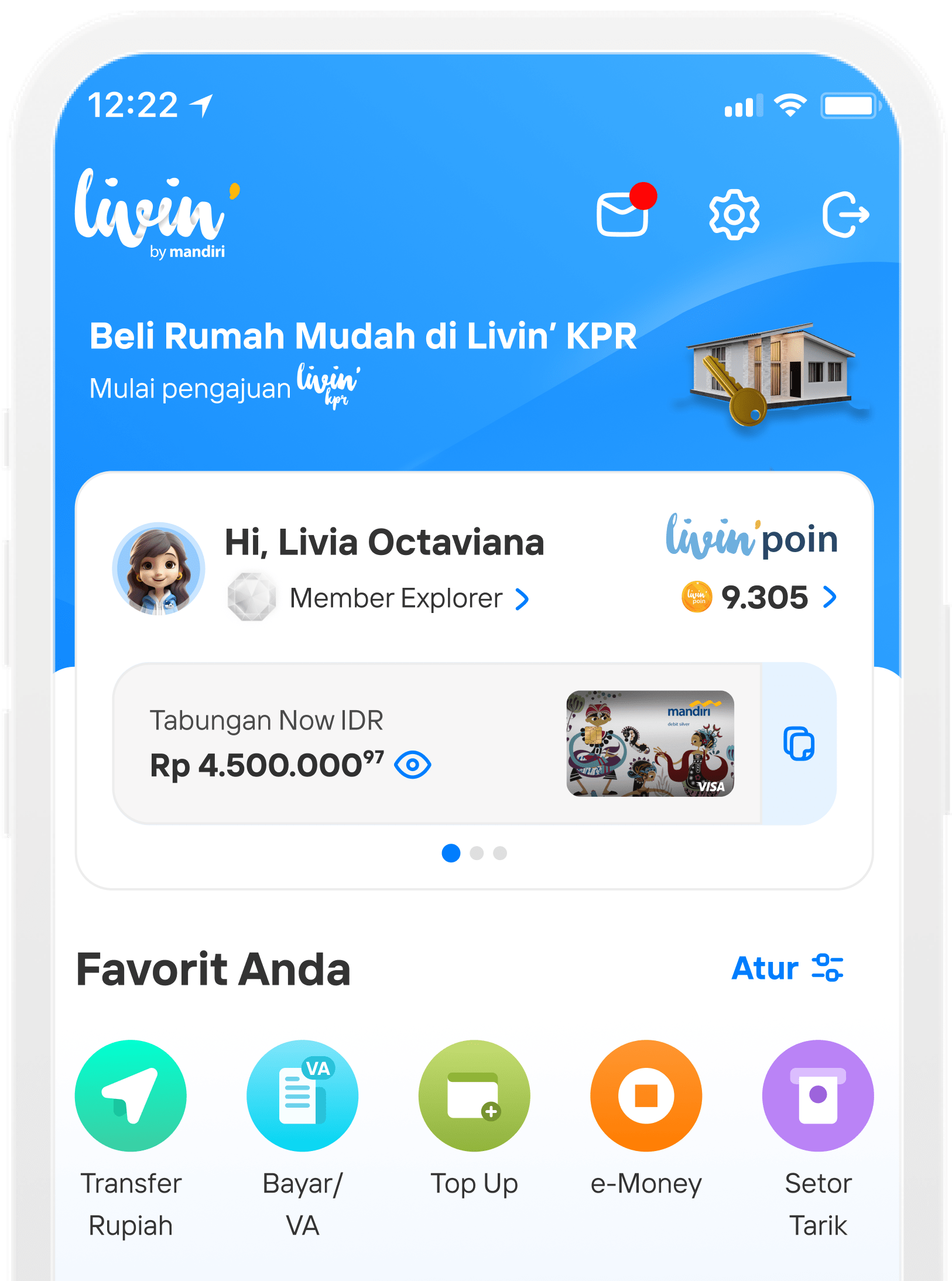

Di mana pun, kapan pun, apa pun device kamu,

Download Aplikasi Livin’ by Mandiri

Dan dapatkan kemudahan dalam segala urusan finansial sekarang