Mandiri KPR Multiguna Top Up

Mandiri KPR Multiguna Topup New

Mandiri KPR/Multiguna Top Up

With Mandiri Multiguna Top Up, Not 1, But 2 Houses at the Same Time!

Mandiri KPR/Multiguna Top-Up

Get additional credit limit facility for an existing Mandiri KPR/Multiguna loan with optional tenor extention and use it for various needs.

You can use the Top Up limit for:

1. New house/property financing

2. Home renovation/other properties

3. Education

4. Automotive (Car/Motorcycle)

5. Other credit repayment.

The Benefit of Mandiri KPR/Multiguna Top Up

1. Competitive Rate

2. Current credit facility will follow the new Top Up rate

Example:

Current Credit Facility

Initial Limit

Rp. 5,000,000,000

Remaining Limit

Rp 4,309,770,155

Remaining Tenor

168 Months

Current Interest Rate

13.25% (Floating)

Current Installments

Rp 58,979,951

Credit after Top Up

Top Up Limit

Rp 1,000,000,000

New Limit after Top Up

Rp 5,309,770,155

New Tenor

168 Months (Stayed the same)

New Interest Rate

8.55% Fixed 3 years

14.00% Floating for the 4th year ect

New Installments

Rp 54,308,420 Fixed 3 years

Rp 69,019,404 Floating for the 4th year ect

Current Credit Facility

Initial Limit

Rp. 5,000,000,000

Remaining Limit

Rp 4,309,770,155

Remaining Tenor

168 Months

Current Interest Rate

13.25% (Floating)

Current Installments

Rp 58,979,951

Kondisi Setelah Top Up

Top Up Limit

Rp 1,000,000,000

New Limit after Top Up

Rp 5,309,770,155

New Tenor

168 Months (Stayed the same)

New Interest Rate

8.55% Fixed 3 years

14.00% Floating for the 4th year ect

New Installments

Rp 54,308,420 Fixed 3 years

Rp 69,019,404 Floating for the 4th year ect

3. Long Tenor following year of working

4. Credit pre-realization cost can be deducted from the top up limit

5. Large limit, max. Rp 15.000.000.000,- (fifteen billion) rupiah for KPR and Rp. 10.000.000.000,- (ten billion) rupiah for Multiguna (refinancing)

6. Income documents and collateral can be not included (attached)*

7. Quicker credit process

*) As long as the proposed top up limit does not exceed existing credit facility limit. Further info: bmri.id/kprtopuppreapproved

What’s the risk of a Mortgage?

Several risks that could happen for Mandiri KPR:

1. Changing Economics and politics situation risk

2. Liquidity risk

3. 3rd party default risk

4. Changing laws and regulations risk

5. Force Majore risk (natural disasters/extraordinary events)

6. Other risks stated on the Syarat-Syarat Umum Perjanjian Kredit Konsumtif (SUKK)

Mandiri KPR/Multiguna Top-Up Rate:

Further info about current mortgage interest rates visit bmri.id/kprbungaspesial

Mandiri KPR/Multiguna Top-Up Term and Conditions

1. Existing debitur of Mandiri KPR/Multiguna, with Indonesia Citizens (WNI) and live in Indonesia

2. Minimum age of 21 years and when the credit ends, a maximum of 55 years for employees/according to the company's retirement age

3. Credit has been running for a minimum of 12 (twelve) months

4. Good credit quality for the last 6 months

5. Existing mortgage/multipurpose collateral has Hak Tanggungan status

6. KPR/Multiguna collateral property is still in accordance with its intended purpose

7. Still have the same job status

Program Period

The Top Up period program is valid until application deadline of 31 December 2025.

How to Apply Mandiri KPR/Multiguna Top Up

1. Bank Mandiri customer can apply for Mandiri KPR/Multiguna Top Up online by downloading the form below and upload the documents that have been filled ini and signed in the form of scans or photos sent via email to mandirikpr@bankmandiri.co.id

2. The application form which must be filled in and completed, can be downloaded via the following link/scan QR code:

3. Customer fills in and signs the downloaded form

4. Customers takes a photo/scan of:

• KTP

• Selfie looking in front holding the KTP

• Form Mandiri KPR Top Up

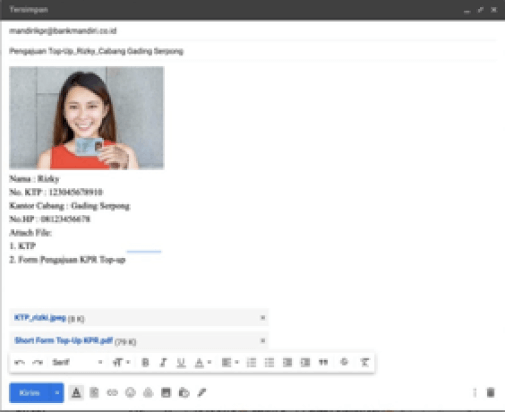

5. Photo/scan results according to the points above can be sent via email to mandirikpr@bankmandiri.co.id with the following format:

• Title/Subject email: Pengajuan Top Up_Nama Debitur_Cabang Pengajuan Awal

• Attach File according to the required documents

• Email body:

Pengajuan Mandiri KPR Top Up

1. Name

2. KTP Number

3. Initial application branch Mandiri

4. Phone number

Judul/Subject Email

Pengajuan Top Up_Rizky_Cabang Gading Serpong

Body Email

Nama : Rizky

No. KTP : 123045678910

Kantor Cabang : Gading Serpong

No.HP : 08123456678

Attach File

• KTP

• Swafoto/Selfie tampak depan debitur dengan memegang KTP

• Form Mandiri KPR Top Up

Contoh Format Email :

6. Or you can also come directly to the nearest Bank Mandiri branch or Consumer Loans Area of your initial Mandiri KPR/Multiguna application.

Customer phone number/WA/email address must be active, it required to receive information if the application is approved.

Further information, please contact the nearest Bank Mandiri Branch Office or contect Mandiri call 14000 and/or Whatsapp MITA at 08118414000 by typing “ Mandiri KPR Top Up”.